Life insurance

If you’re a healthy, HIV-negative gay man with no sexually transmitted diseases, who practises safe sex, you would expect to be treated as any other member of the population when purchasing life insurance, right?

Unfortunately, this may not be the case.

Some major insurers around the country are requiring applicants to disclose whether they have engaged in anal sexual intercourse on the assumption that, if they have, they will have exposed themselves to a higher risk of contracting HIV/AIDS.

AMP, Tower, and MLC all require you to disclose this. None of them ask you to stipulate whether you have engaged in safe sex only.

It is important to note that not all insurers include these disclosure requirements. AXA in its AC & L/ AXA Application Form for Life Insurance asks, “In the last three years, are you aware of any HIV risk situation to which you or any of your sexual partners may have been exposed? Note, HIV risk situations include but are not limited to … anal intercourse (excepting in a relationship between you and one other person only and neither of you have had sex with anyone else for at least three years).”

Other major insurers, such as CommInsure, ING and Allianz, do not include sample application forms within their product disclosure statements, so it is not possible to say whether they include such a declaration.

It is important to consider the legal position of disclosure requirements. The Human Rights and Equal Opportunity Commission notes on its website:

A gay man complained he had been discriminated against on the basis of an imputed future disability (that is, the risk that he might become HIV-positive) when an insurance company refused to give him income protection insurance, even with an HIV exclusion clause (which the complainant was prepared to accept), for longer than a two-year period. The matter was settled without admission of liability when the insurer advised that it had reconsidered its decision and was prepared to remove the two-year limitation and issue the policy as requested.

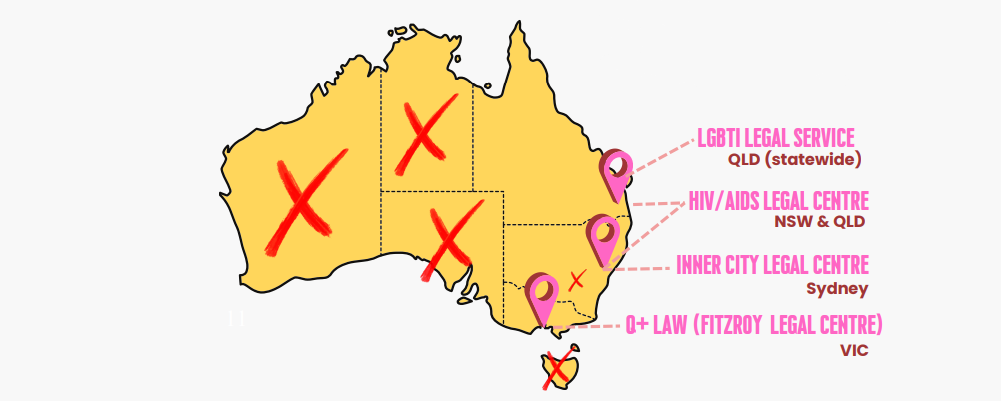

If you have been refused life insurance on the basis that you have disclosed that you have engaged in male sexual intercourse, you may wish to pursue a claim with HREOC. They can be contacted on 1300 656 419 or at www.hreoc.gov.au. You might also wish to contact the Financial Industry Complaints Service on 1300 780 808 for complaints about life insurance products. You can contact the Insurance Ombudsman Service for general insurance complaints on 1300 780 808 also.