What is positive cash-flow property?

By Nick Mills

I have a confession to make. I’m not getting any younger. There, I’ve said it. As I sail into the uncharted waters of life after 40 (or so), securing the financial future for my partner and me has become far more important to me.

I can’t believe I’m saying this in print, but yes, it has become more important than what I’m doing for Mardi Gras.

Over the past couple of years, as my waistline fluctuated, so too did my shares and superannuation. In fact, my superannuation lost more weight than I did last year, which was not the desired result.

However, for a number of years I have also invested in property, both singly and with my partner, Craig.

If you too have been interested in investing in property but were either scared to make the first move, or just didn’t know where or when to buy, I have felt your pain. Investing in property does not have to mean losing money or making a big financial commitment each week. In fact it can actually cost you very little or even make you money upfront if you buy in smart areas.

Craig and I have been purchasing properties for a while now and we aim for neutral or positive cash-flow properties. A neutral cash-flow property is one that basically pays for itself and doesn’t need you to chip in extra cash each week. A positive cash-flow property is one that gives you money in your pocket after the mortgage and bills are paid.

This is different from negative gearing, where you often have to contribute large cash amounts to support the property. While this can have tax advantages for some people, it can also put a strain on your finances. Saving tax shouldn’t be your main reason for investing — capital growth and cash flow are much more important.

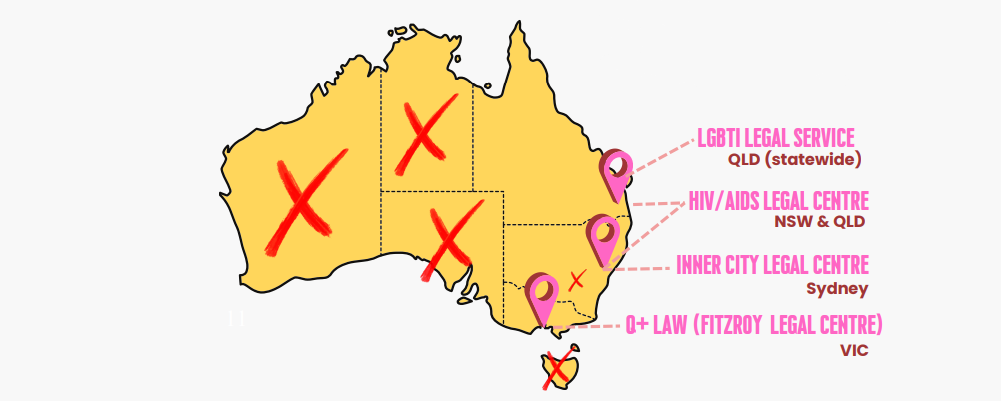

Positive cash-flow property doesn’t exist in every street in every town but with the right research it can be found. The type of property you need to look for will give you reasonable rent returns plus tax breaks so you can claim depreciation on the building and its fittings. If you don’t restrict yourself to your own neighbourhood and even check out other states, you’ll find properties that not only do this but have good growth potential too.

Most of us in our community work damn hard, right? Wouldn’t it be nice to have something to show for it?

Buying properties in different markets around Australia with a focus on capital growth and cash flow can enable you to build a significant property portfolio and replace your current income.

The other really important strategy here is debt reduction. I lived pretty extravagantly in my 20s and racked up some massive credit card bills. What I have since learned is how to still live well but reduce my debt at the same time.

Now, just because I said investing was more important than MG doesn’t mean you won’t be seeing me there this year. Look out for me with the Team Sydney float.

info: To find out more about how we can help, don’t hesitate to contact us on 9460 8400 or email [email protected]